disallowable expenses under section 39(1)

Paragraph 331c of the ITA allows a deduction for the expenses wholly and exclusively incurred for. These conditions are.

Generally repairs and renewals expenses are claimed as deductions from a persons gross income from a business or rental source.

. A deduction for the expenses will be disallowed under section 391A of the Income Tax Act 1967 ITA if the taxpayer fails to. Under subsection 1 of this section shall not be subject to a set off under section. Professional expenses are subsections 331 and 391 of the Income Tax Act 1967 ITA.

AY 13-14 The assessee failed to deduct tax at source but the receiver of such payment i. Payment of GPF CPF and ESI beyond due date If the amount has been deposited on or before the due date us 139 1 then the amount cannot be disallowed under Section 43B of the IT. Act or under Section 36 1 va of the Act.

The question at hand is whether CSR Corporate. The question to be decided is whether the expenditure was an outgoing or expenses wholly and exclusively incurred during that period by that person in the production of gross income from that source in section 33 as qualified within set limits by section 39. UPDATED 06062021 SECTION 33 OF ITA 1967.

UPDATED 06062021 Here are most common ALLOWABLE EXPENSES. For instance if hall rental is for a wedding planner or event manager of course these rental. Effective YA 2013 the amount of RR costs that qualify for tax deduction as a business expense is capped at 300000 for every relevant three-year period starting from the year in which the RR costs are incurred.

Section 39 Furnishing of returns. One must provide substantiating documents that the expense at hand indeed was incurred solely for income generation. Payment can not be disallowed by invoking explanation to s.

Section 391 Every registered person shall for every calendar month furnish a return electronically in such form manner and within such time as may be prescribed. Prior to YA 2013 the cap was 150000 for every relevant three-year period. The words used in this Ruling have the following meanings.

Paragraph 331c of the ITA allows a deduction for the expenses wholly and. A any taxable supply including a taxable supply which is disregarded under this Act. Qualified tuition and related expenses under section 222 attributable to payments made with proceeds of the discharged loan.

Expenses on Repairs and Renewals Generally repairs and renewals expenses are claimed as deductions from a persons gross income from a business or rental source. Only expenditures not specified under Sections 30 to 36 and expended entirely for the company is permitted as a deduction when calculating taxable business profits under Section 371 of the Income-tax Act of 1961. 31 Person includes a company a co-operative society a club an association a Hindu joint family a trust and estate under administration a partnership and an individual.

1 1 Every registered person other than an Input Service Distributor or a non-resident taxable person or a person paying tax under the provisions of section 10 or section 51 or section 52 shall for every calendar month or part thereof furnish in such form manner and within such time as may be prescribed a return. Expenditure Cap on Qualifying Costs. 31 Immediate family members means an employees wife or wives and his children or an employees husband and her children.

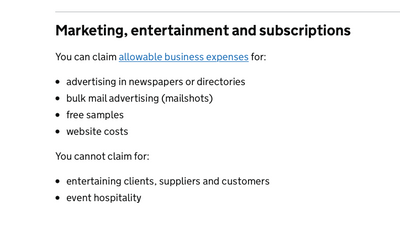

The expense is allowable if the figure quoted is reasonable. B Tax payable under this Act and a fine or similar other fee paid to the government of any country or any local body thereof for a violation of any law or regulation byelaw framed thereunder c Expenses to the extent of those spent by any person to obtain the amounts enjoying exemption pursuant. In respect of expenses that come within the definition of entertainment under section 18 of the Act which are wholly and exclusively incurred in the production of income under subsection 331 of the Act a sum equal to fifty per cent 50 of such expenditure would be disallowed under paragraph 391l of the Act except for the Issue.

Determining whether or not an expense is allowable depends on the information youve on entered on your Tax Profile. Or c any other supply as may be prescribed. UNDER SECTION 33 ITA 1967.

If an expense is not wholly and exclusively used for business purposes then it is considered a disallowable expense and cant be claimed as a deduction to lower the taxable income. Insurance marked as disallowable expense. Allowable expenses are costs that are essential to running your business but does not include money used to pay for personal purchases.

B any supply made outside Malaysia which would be a taxable supply if made in Malaysia. 1EXPENSES THAT ARE NOT INCURRED. Employment costs to employees such as salary.

Additional medical expenses tax credit 31 Disability Under section 6B3b of the Act a taxpayer who has or whose spouse or childhas a disability as defined that is in accordance with criteria prescribed by the Commissioner for SARS in the ITR -DD form will be able to claim qualifying medical expenses inclusive of VAT. 2 Input tax attributable to any exempt supply shall be treated as input tax attributable to a taxable supply. Also there are types of expenses arent business allowable depending on your business operation entity and local regulation.

However the allowable expenses under subsection 331 of the ITA are subject to specific prohibitions under subsection 391 of the ITA. The IRS will not assert that a creditor that is an. An expense is warranted as an allowable expense only if it is wholly and exclusively incurred for revenue production.

Expenses that may not be deducted. There are two instances under Section 37 when expenses are disallowed. A request for payment of rehabilitation expenses under Section 39c2 must be made to the deputy commissioner for the compensation district in which the claimants injury occurred and not the Office of Administrative Law Judges since an award for such expenses is subject to the discretion of the Secretary of Labor and the Secretary has.

Disallowable expenses incurred by an employee would be assessable. 37a penalty for failure to make deductions under section 35. RAJASTHAN HIGH COURT.

32 Child means a legitimate child or stepchild of an employee his wife or her. A submit all the records or documents that meet the requirements specified in the notice issued under section 81 of the ITA or b furnish the required information within the timeframe stipulated in the. 2014 366 ITR 163.

ADJUSTED INCOME GENERALLY SECTION 39 OF ITA 1967. Has furnished his return of income under section 139. Specific prohibitions under subsection 391 of the ITA.

The Input Tax Distributor ISD non-resident taxable person the person paying tax under composition scheme under section 51 TDS or section 52 TCS by e-commerce operator are not required. Ia Any payment other than salary for which TDS is applicable but not deducted or after deduction has not been paid during the previous year or before due date us 1391. Section 18 subsection 331 and paragraph 391l.

7 To be allowable under section 331 expenses must fulfill all the following. While there is no Limit on expense categories there are types of expenses that are not business or are not reportable and this depends on your business operations your entity type and the local regulations that apply. This revenue procedure amplifies Rev.

Decided in favour of the assessee. Interpretation The words used in this PR have the following meanings. Expenses disallowed under paragraph 391l of the act.

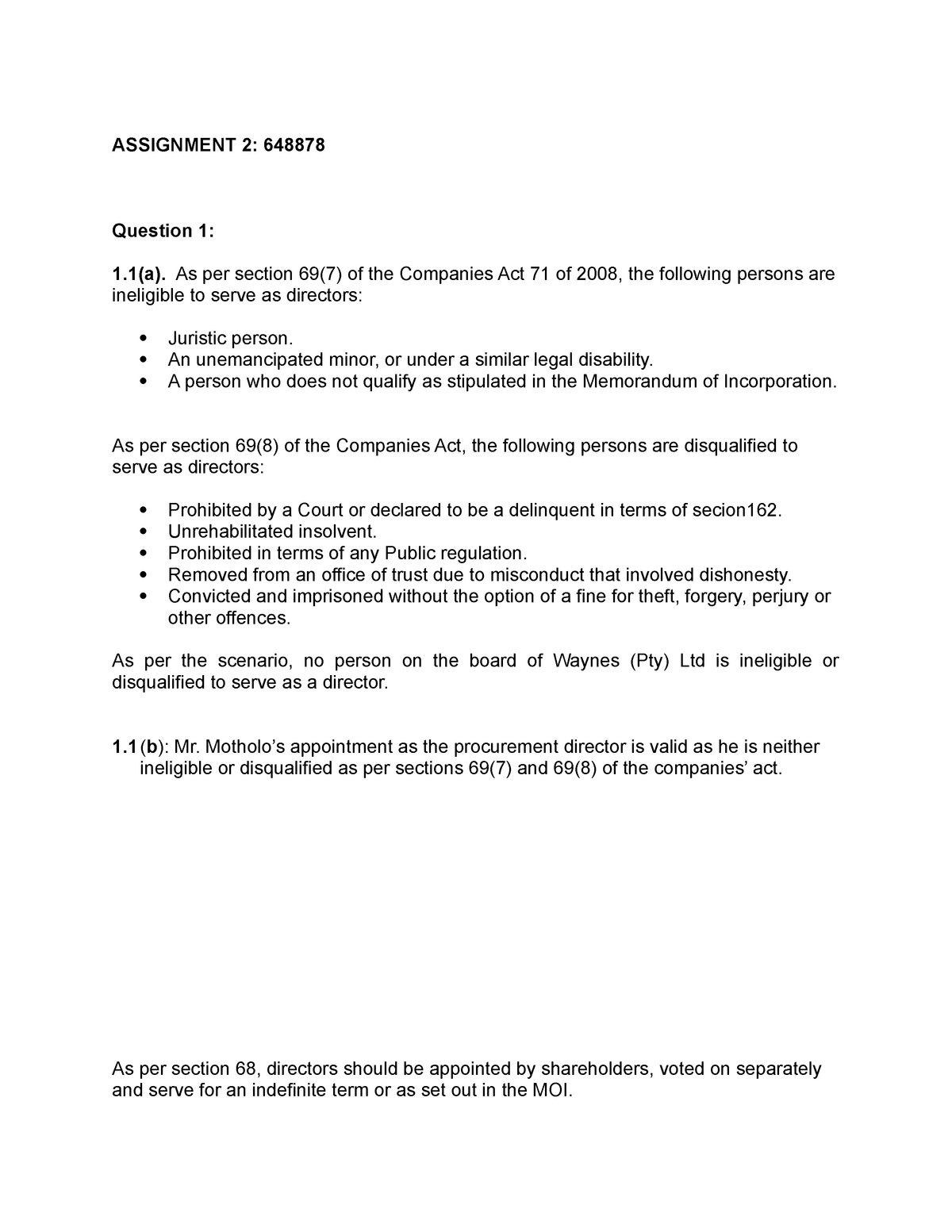

Assignment 64887812 Assignment 2 648878 Question 1 1 A As Per Section 69 7 Of The Companies Studocu

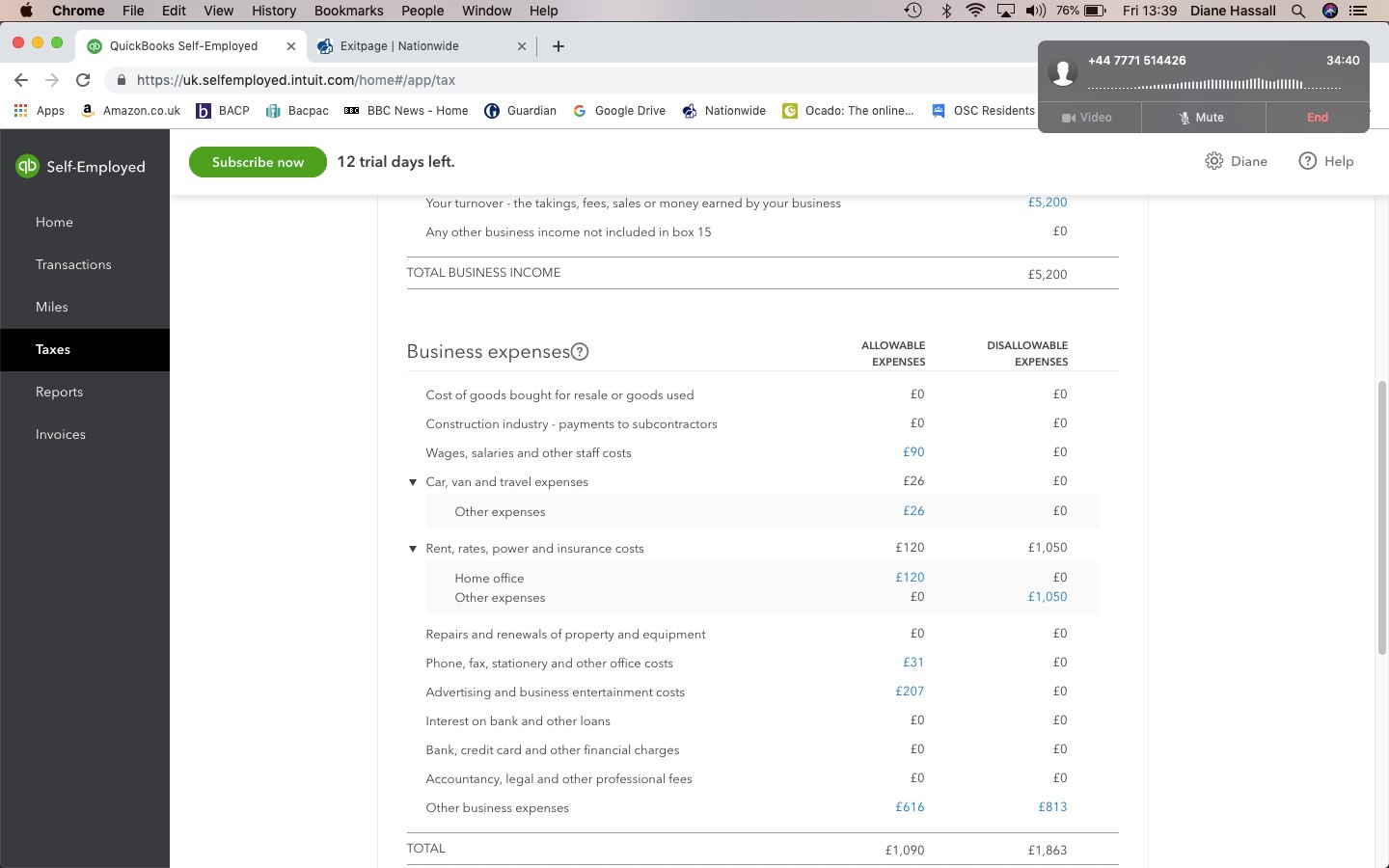

Solved Why Is Rent Showing As A Disallowable Expense

Problem Based Learning Project Tax Computation On Malaysian Food Service Mfs Sdn Bhd Group B Namematrik No Izwani Bt Abdul Majid Hazwani Bt Ghazali Ppt Download

Solved How To Change Disallowable Expenses To Allowable

Solved How To Change Disallowable Expenses To Allowable

Business Deductions By Associate Professor Dr Gholamreza Zandi Ppt Download

Expenses Allowed Disallowed In Income Tax Youtube

Solved Why Is Rent Showing As A Disallowable Expense

Partnering Iras To Invest In Real Estate Real Estate Investing Investing Real Estate Investing Rental Property

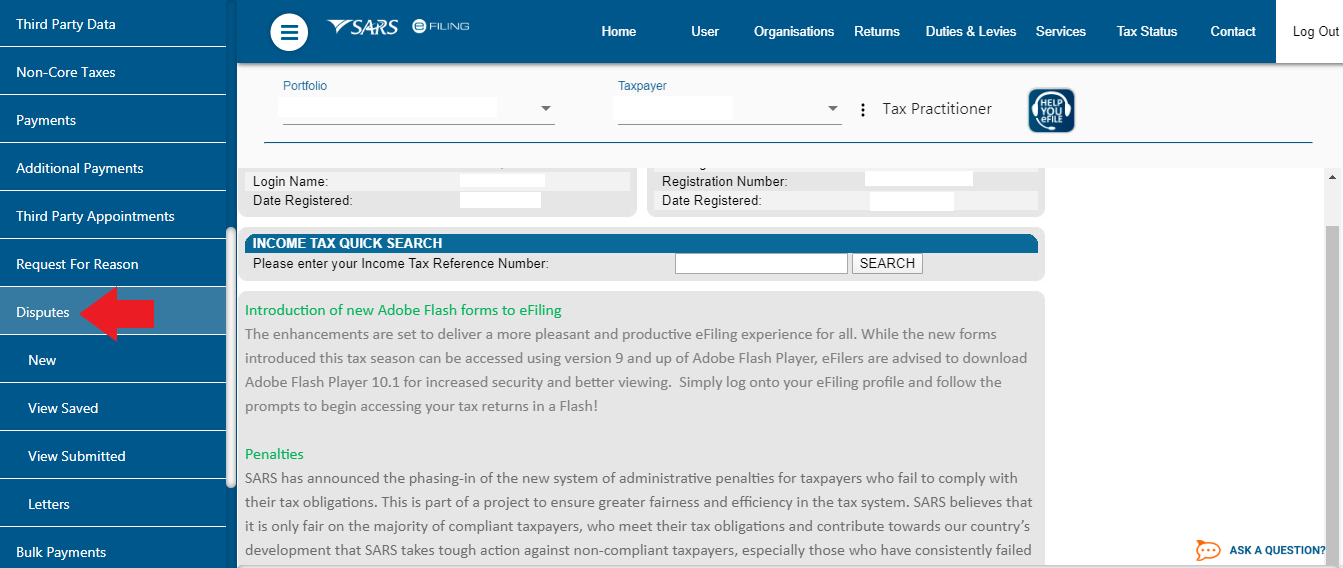

9 Steps To File An Objection To Your Tax Assessment Taxtim Blog Sa

Business Deductions By Associate Professor Dr Gholamreza Zandi Ppt Download

No comments for "disallowable expenses under section 39(1)"

Post a Comment